Taxi and Private Hire Drivers Statistics in the UK (2024)

Introduction

The taxi and private hire driver industry plays a crucial role in the UK’s transport network, providing essential services for millions of passengers. With ride-hailing apps, local minicabs, and traditional taxis all competing for market share, it is important to understand the latest trends in driver numbers, licensing, and regional distribution.

This article provides a comprehensive analysis of taxi and private hire driver statistics in the UK, highlighting industry growth, challenges, and future opportunities.

The Rise of Private Hire Drivers in the UK

As of April 2024, the number of taxi and private hire drivers in England has reached 381,100, a 10% increase from 2023. The private hire vehicle (PHV) sector continues to dominate, accounting for nearly 69% of all licensed drivers.

Taxi and Private Hire Driver Statistics (2024)

Region

Total Drivers

Private Hire Drivers

Taxi Drivers

Dual Licence Holders

London

123,600

106,200

17,400

N/A

England Outside London

257,500

156,600

16,700

78,200

Total (England)

381,100

262,800

34,100

78,200

Key Takeaways

- Private hire drivers make up 262,800 (69%) of total drivers in England.

- Taxi drivers are significantly fewer, with 34,100 (9%) still operating.

- Dual licence holders (drivers licensed for both taxis and PHV) account for 20% of the total

Regional Breakdown of Taxi and Private Hire Drivers

London

- 106,200 private hire drivers dominate the transport market.

- 17,400 taxi drivers remain in service, a decline compared to previous years.

- The rise of Uber, Bolt, and FreeNow has significantly reshaped the market.

England (Outside London)

- PHV drivers (156,600) remain the majority, with taxis at 16,700.

- Cities like Manchester, Birmingham, and Leeds experience high PHV demand.

- 78,200 dual licence holders operate in multiple roles, balancing taxi and private hire work.

Industry Trends and Growth Factors

🚖 Growth of App-Based Private Hire Services

The number of taxi and private hire drivers continues to grow due to increasing demand for ride-hailing apps like Uber, Bolt, and Ola.

⚡ Shift to Electric and Hybrid Vehicles

With ULEZ regulations in London and eco-friendly incentives, many drivers are switching to hybrid or electric vehicles to meet compliance standards.

📉 Decline in Traditional Taxi Drivers

The total number of taxi drivers has declined by 5%, indicating a shift towards private hire work, which offers greater flexibility and higher earnings potential.

📊 Increase in Dual Licensing

Drivers are choosing to hold both taxi and PHV licenses, allowing them to switch between services based on demand.

Visualising the Data

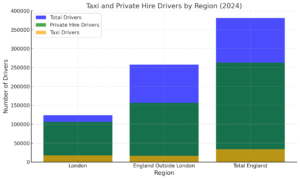

Taxi and Private Hire Drivers by Region (2024)

The chart below shows the distribution of taxi and private hire drivers across different regions.

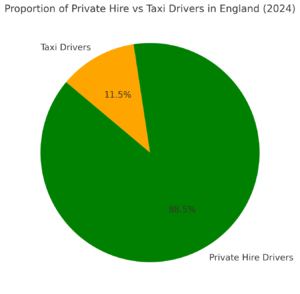

Proportion of Private Hire vs Taxi Drivers

The pie chart below illustrates the dominance of private hire drivers in the UK

Future Outlook for Taxi and Private Hire Drivers

🔹 More drivers are shifting to private hire work due to flexible hours and fewer restrictions.

🔹 Regulatory challenges remain a concern, with councils imposing stricter licensing rules.

🔹 Electric vehicle adoption will continue to rise, with many cities introducing low-emission zones.

Key Challenges Facing Taxi and Private Hire Drivers

- Rising operational costs (insurance, vehicle maintenance).

- Increased competition from new drivers entering the market.

- Regulatory uncertainty and changing licensing requirements.

Conclusion

The taxi and private hire driver industry in the UK is evolving rapidly. Private hire drivers now account for nearly 89% of the workforce, with taxi drivers facing growing challenges. The future of the industry will be shaped by ride-hailing platforms, sustainability initiatives, and regulatory changes.

For anyone considering entering the industry, understanding these trends and statistics is crucial for success in 2024 and beyond.

Source:

Department for Transport

Related: